BMS CAPITAL

Ready to Sell Your SME Business?

We offer a straightforward, transparent path to selling small and medium-sized businesses.

BMS Capital focuses on a buy-and-merge strategy, smart acquisitions, operational improvements, and committed to preserve the unique culture of each business we acquire while expanding their reach and revenue.

Our Snowball Strategy

We specialise in acquiring established, profitable small to mid-sized enterprises and provide a clear, straightforward process for owners exploring a potential exit.With deep industry experience and strong backing from Opulentia Capital, we specialise in acquiring profitable UK-based SMEs—typically those earning £500,000 or more in annual profits. Our goal is to unlock growth through a buy-and-merge strategy, using complementary acquisitions to expand operations, enhance value, and deliver exceptional returns.

What businesses We are looking for

We’re actively looking to acquire businesses that:

- Generate annual revenues of £2 million or more

- Have a solid profit history

- Have been operating for 5+ years

- Are supported by a reliable management team or the opportunity to promote existing staff into management roles.

What We DO

Finding the right buyer for your business isn’t always easy and can feel overwhelming—especially for SME owners whose companies may not fit the profile for venture capital or attract the attention of large private equity firms. That’s where we offer a unique solution, simplify the process and reduce the stress.Our goal is to ensure you receive the best possible return. We are committed to working diligently to acquire your business and will do our utmost to meet your value expectations.

Whether you're planning to sell your business or seeking a partner for growth, we collaborate closely with owners to ensure a seamless transition that supports all stakeholders—particularly the team that helped build the business.

Our priority is to help you achieve the best possible outcome while preserving the legacy and culture you’ve worked tirelessly to establish.

Unlike venture capital firms that focus on early-stage startups or private equity houses that serve large corporates, we focus on the vital space in between—established SMEs that often lack clear exit options. Our approach creates a practical and rewarding path for owners seeking a new chapter.

A Strategic Exit Partner for SME Owners

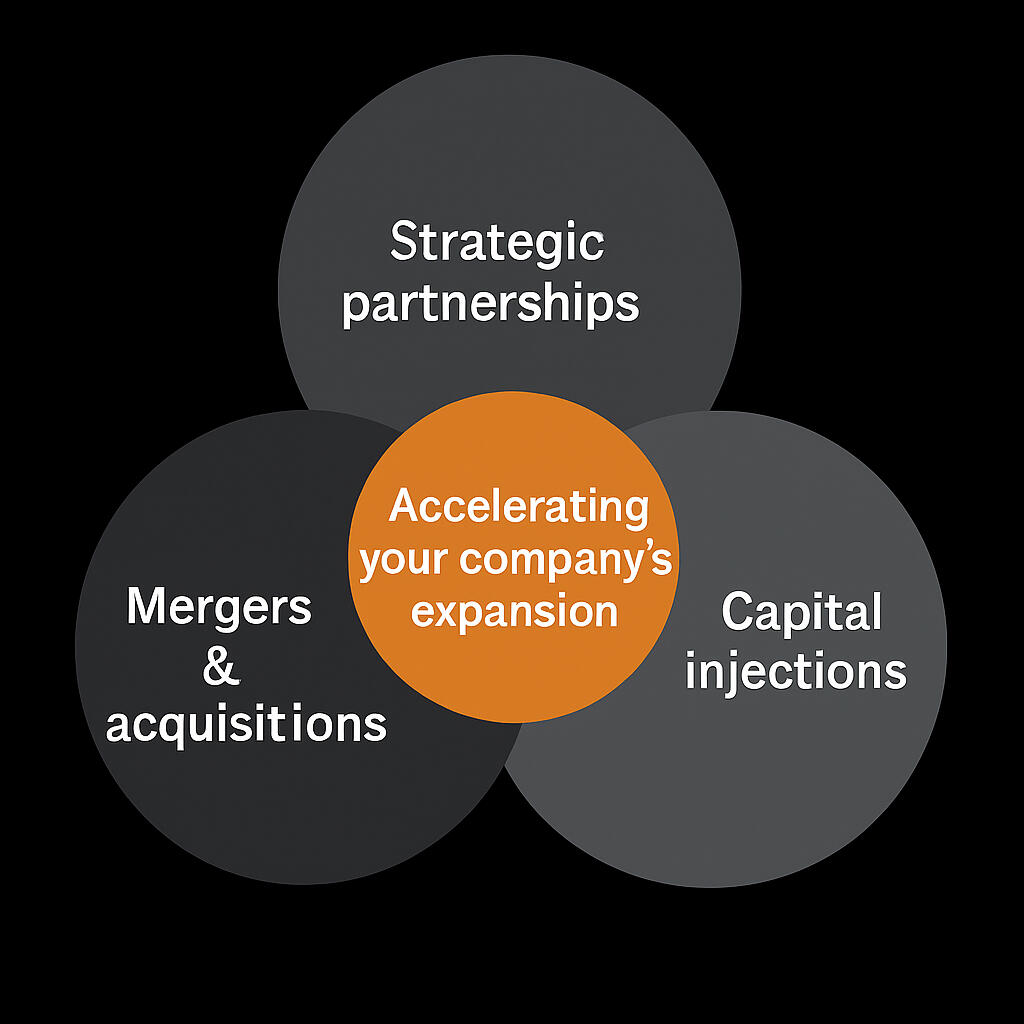

Our goal is to maximise shareholder value and fuel business growth following acquisition through a three-fold strategy:First, by driving expansion via ongoing mergers and acquisitions, including bolt-on opportunities.Second, by harnessing strategic partnerships within the Opulentia Capital group to improve operational efficiency.Third, by investing directly into the business—developing internal talent, streamlining processes and systems, and leveraging technology to enable and support growth.

Our Philosophy

This isn’t a numbers game for us. Every business we acquire is a long-term commitment. We give full attention to every business acquired, helping people unlock value, and carrying their legacy forward, not wiping it clean.People are at the core of our philosophy. We believe in building genuine relationships—getting to know those we work with, and allowing them to truly know us. I hope this gives you a clearer sense of who we are and the values that guide us.

Contact us

Interested in getting to know us better?

Feel free to reach out with any questions or comments.

Let's Talk

If you're considering what the next chapter might look like for you and your business, let’s start a conversation. No pressure, no sales pitch — just a genuine conversation.